>Clean Up Your Credit Card Debt│Credit Law Center

Leaving Credit Card Debt Behind

Credit Card debt is increasing for many American families. According to Experian, most family units with a bank card that consists of over $6,000 in debt. For many, this debt can be hard to manage! Do you keep asking yourself why your debts continue to pile up with little to no headway made month to month?

One can only crunch numbers so many times over again. You may find that the numbers are rarely moving and potentially increasing without using the cards. Read more on 3 tips to help you get out of debt and manipulate your finances to make the most impact.

-

Consider Your Budget

Start with being honest with yourself about spending. What can you cut back on the short term? Have you looked at how much you are nickel and diming yourself? It may come as a shock what you find is left over after you cut random spending out.

List out all of your debts, balances, monthly funds, and due dates. Move money around that is strictly for bills only and the deadlines you have for each. Now, what is left? Is there any wiggle room? Decide what is most important next.

If you enjoy apps on your phone, Mint now has a great updated app that tells you where you ended up overspending for the month.

A great rule of thumb is to tackle the lowest credit card first and make a larger lump sum on your payment so that one gets paid down quickly. Once you see one balance start to deplete, the other cards may seem more manageable. While the funds you had for “other” activities may be small, the thought of not having a cloud of debt following you around is much better!

-

Seasonal Job Searching

Also known as the side hustle. Although making a few extra hundred dollars a month may not seem like a lot when you are giving up your free time on evenings or weekends, having a seasonal job that is strict to work to pay the debt off quicker is absolutely worth it. When you have set yourself up on a tight budget and you start working a side job, the money will be a tool to accomplish your goals faster.

Don’t Cut Out all the Fun!

Paying bills is never the fun option however, the freedom from debt will be worth it in the end. If you have found after combing through your finances that you were spending way too much money at the movies or out to lunch, cut back enough to save but try not to completely eliminate everything you do. You may find if you allow for no fun, the budgeting will become harder for you and you will ditch the process in order to continue to live the life you were living. Moderation at this point in the process is key!

-

Debt Consolidation or Debt Negotiation

You may find terms on the internet about debt consolidation or debt negotiation. There are many companies out there that can do one but not the other. Conduct plenty of research before getting into a company that is for debt consolidation vs debt negotiation.

Debt consolidation typically means you’re actually incurring more debt. The fact is, debt consolidation does not mean debt elimination. These companies are actually just restructuring the debt rather than wiping it away for you.

If you are wanting to get rid of debt, the quickest way to do so is to delete the items.

The flip side of this is debt negotiation. Credit Law Center has attorneys on staff that can help you through this process. This is where eliminating debt actually takes place! Negotiating debts down with the creditors you owe help you attain your goals more quickly than debt consolidation will. Remember that never-ending cycle of debt? It will just continue with debt consolidation. But, with debt negotiation, the end may be near!

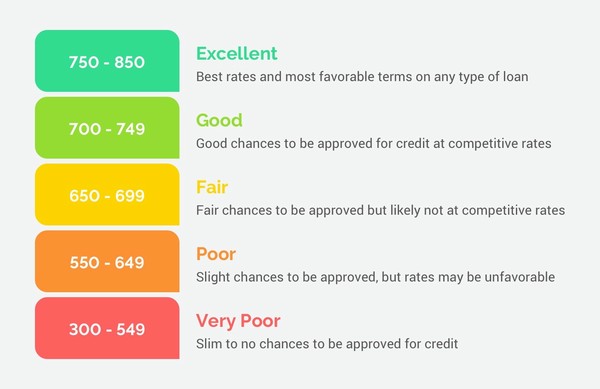

Following any of these three options listed is a sure-fire way to start knocking down debt and potentially increasing your credit scores. 30% of your credit score is made up of the utilization on your credit cards. Therefore, if you have several accounts that are maxed out, you probably noticed your credit scores are significantly lower than they could be. In all reality, credit plays a major role in our day to day lives. If you find that you are in a place that you need financial or legal advice, please give Credit Law Center a call today 1-800-994-3070.