As a consumer, you are probably well aware that lenders often use your credit information for various reasons. Whether you are renting an apartment or buying a car, you can pretty much always expect your credit to be checked, but did you know that there a many other companies that have access to your credit report? Collection agencies are amongst the most popular types of companies to do this without your consent.

A collection agency is an organization that specializes in collecting an individual’s or a business’s debt. They use your credit report for two reasons. The first is skip tracing. Skip tracing is how collection agencies find those difficult to locate consumers. They use credit reports to find those consumers because your credit report lists your current and all of your former addresses. This makes it easy for debt collectors to locate you.

The second reason a collection agency might want to view your credit report is to see what you can afford. Viewing your entire credit report can help debt collectors decide if you would be able to pay off your debt or not. They can also use your credit report to go as far as to decide whether or not to sue you.

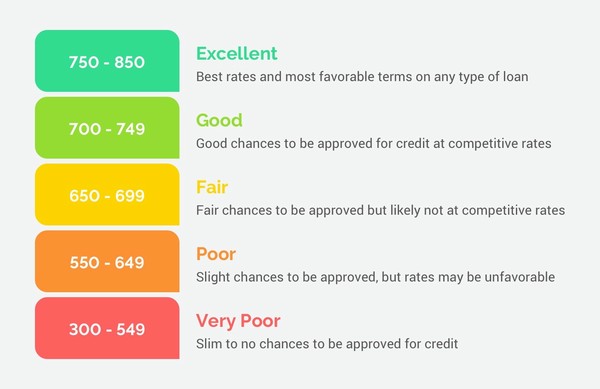

Your credit score is a good indicator of your ability to pay, and your collection score is a special type of credit score that relates specifically to being able to pay back debt. If you have a collection score that indicates you would most likely be able to pay your debt, then a collection agency will put forth more time and energy into trying to collect your debt versus someone with a worse collection score.

Anytime your credit is pulled, regardless of who does it, a record of the access, or an inquiry, is posted. There are, however, two different types of inquiries. A soft inquiry occurs when you pull your own credit report just to review it. These do no harm to your credit score. A hard inquiry, though, can negatively affect your score. Those occur when your credit is being checked by a lender. Unfortunately, inquiries from collection agencies can be either, meaning there is a chance your score could be damaged if a hard inquiry is posted.

Knowing that collection agencies can check your credit information without your consent can be frustrating. It might even prompt you to question whether or not it is legal for collection agencies to do this. Well, the short answer is yes, it is legal.

As long as the collection agency uses your credit information to help with their debt collection, then it is fair game for them to pull it. The Fair Credit Reporting Act (FCRA) states that any consumer reporting agency can access consumer reports if they have reason to believe they can use that information to collect debt, thus establishing the official legality of the collection agencies accessing your credit information.

This site provides general info & entertainment & should not be considered financial advice. Consult an independent financial advisor for your specific situation.

Per FTC guidelines, this site may be compensated by companies mentioned through advertising & affiliate partnerships.